Does My Hybrid Qualify For Tax Credit

Another factor which determines the tax credit amount is the amount of taxes that you owe to the federal government. This credit is nonrefundable and will only offset your tax liability for a given tax year.

Are The Tax Rebates For Electric And Hybrid Cars Worth It Loans Canada

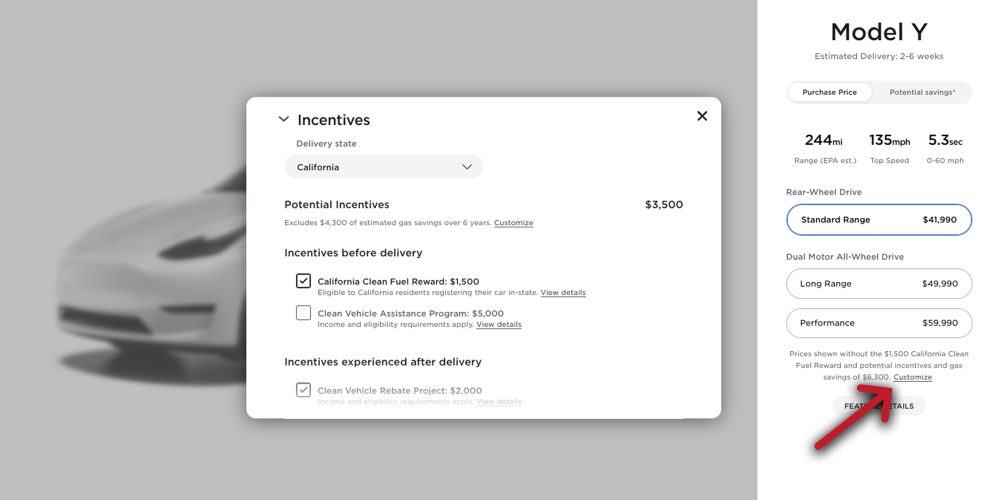

Plug-in hybrid vehicles can get 1500 and battery electric vehicles can get up to 3500.

Does my hybrid qualify for tax credit. For starters non-plugin hybrid tax credits no longer exist at the federal level. This state take a more specific approach to making individuals qualify for rebates. It must be purchased in or after 2010.

Uniform Energy Factor UEF 22. Uniform Energy Factor UEF 082 OR a thermal efficiency of at least 90. If you purchase or lease a Jeep Wrangler 4xe you might be eligible for up to a 7500 federal tax credit 1.

The state of Delaware has bumped up their rebates by 1000 over other states like Maryland. A number of luxury cars and SUVs have plug-in hybrid variants qualify for a federal tax credit. The following criteria must be met in order to receive a tax credit of 300.

Purchasing an all-electric or plug-in hybrid vehicle can qualify you for a federal tax credit worth up to 7500 as well as other incentives of various amounts. That means you can go green without sacrificing style performance and luxury while Uncle Sam keeps fuel-saving technology from busting your budget. No the Federal Government ended non-plug-in hybrid credits some time ago.

One of our favorite luxury PHEVs is the 2020 Volvo XC90 T8. However if you are driving a plug-in hybrid electric vehicle which still uses some gasoline then you may not qualify for the full 7500. The idea in theory is quite simple All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to.

GET FEDERAL TAX CREDITS AND STATE INCENTIVES FOR YOUR WRANGLER 4xe We have some great news. Federal Tax Credit Up To 7500. All-electric and plug-in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Now Fords Fusion Hybrid as well as the Mercury Milan Hybrid qualify for the maximum tax credit as well giving buyers a 3400 break on the purchase of either of. In order to qualify you have to be full electric or a plug-in hybrid. However buying an electric vehicle EV outright has one big financial advantage over leasing.

Federal Tax Credits for All-Electric and Plug-in Hybrid Vehicles. Regular hybrids which dont plug into external chargers dont qualify for the federal electric vehicle tax credit and rarely qualify for state or local EV incentives. No it does not qualify for the federal tax credit.

Gas Oil or Propane Water Heaters. Car and Other Things You Own. Does purchasing a toyota rav4 Hybrid give you a deduction.

You may deduct sales tax and property tax on the purchase. You may also be able to amend a tax return to claim credit if you purchased it in a previous year and owed taxes. If you purchased a hybrid motor vehicle in 2020 you may be able to claim credit on your 2020 Tax Return.

In order to receive a tax credit of 300 the electric heat pump hybrid water heater must meet the following criteria. Plug-in vehicles may be. The credit amount will vary based on the capacity of the battery.

Check with your state however as they have some states still offer an incentive. Toyota Rav4 2016 doesnt qualify for the energy efficient tax credits though. Electric vehicles are eligible for up to a 7500 tax credit with a few caveats.

You must be the original owner. See below for the Toyota cars that do qualify. The property taxes on your car are deductible as follows.

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Electric Car Tax Credits What S Available Energysage

Chrysler Pacifica Hybrid Federal And State Incentives Info

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

A Complete Guide To The Electric Vehicle Tax Credit

What Is A Hybrid Car Tax Credit

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

Electric Vehicles Tax Credit For 2020 By Car Model

How To Claim An Electric Vehicle Tax Credit Enel X

Pros And Cons Of Hybrid Cars What You Need To Know Energysage

How Do Electric Car Tax Credits Work Credit Karma

300 Federal Water Heater Tax Credit Ray S Complete Plumbing

U S Senate Panel Advances Ev Tax Credit Of Up To 12 500 Autoblog

Post a Comment for "Does My Hybrid Qualify For Tax Credit"